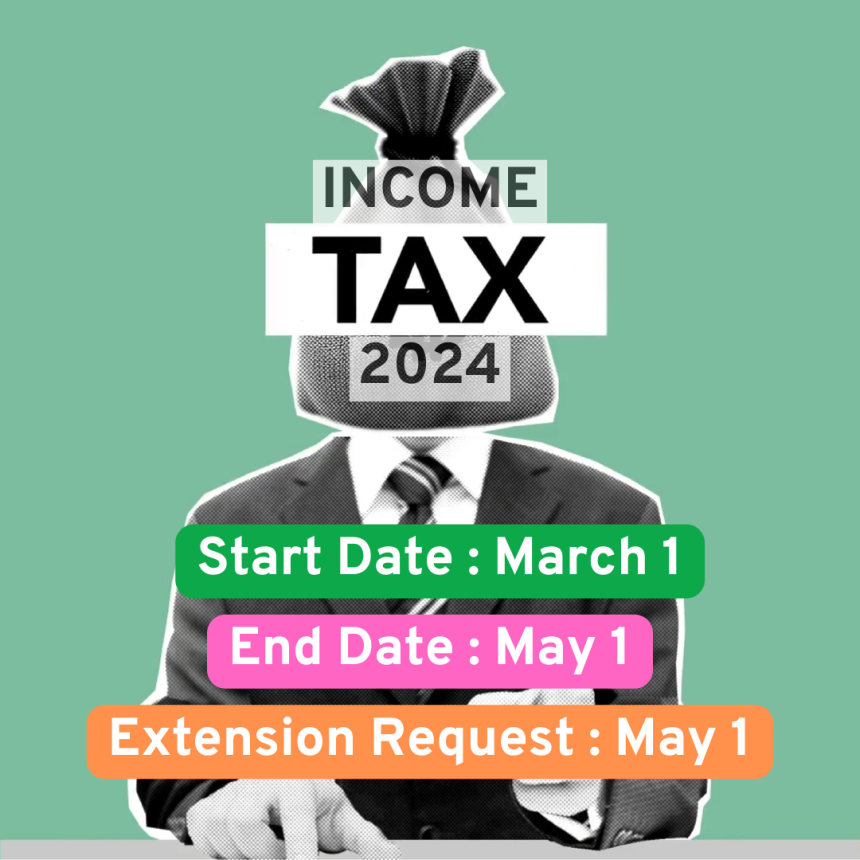

2024 Income Tax (Inkomstenbelasting) Filing Period Opened

From March 1 to May 1

Income Tax Declaration Process in the Netherlands

The income tax (inkomstenbelasting) declaration process for 2024 in the Netherlands is starting. Taxpayers must submit their aangifte (declaration) by the specified dates. Timely submission is crucial to avoid penalties (boete) and expedite the tax refund (belastingteruggave) process.

1. Declaration Process and Extension (Uitstel van Aangifte)

- Start date: March 1, 2025

- Deadline: May 1, 2025

- If the declaration is submitted by April 1, 2025, a response can be expected by July 1, 2025.

- If you miss the deadline, you can request an extension (uitstel van aangifte).

How to request an extension:

- Online application: Submit via Mijn Belastingdienst (through DigiD).

- Phone application: Call Belastingtelefoon to request an extension.

- Written application: Send a letter to Belastingdienst.

- Through a tax advisor: A tax consultant or accountant can request an extension on your behalf.

If your request is approved, an extension until September 1, 2025 may be granted.

Important Points:

- The extension request must be made before May 1, 2025 to avoid penalties.

- Typically, an extension is granted until September 1, 2025.

- If you receive an extension, late payment interest (belastingrente) may apply to the amount of tax due.

- If you are filing together, both partners must request the extension separately.

- Belastingdienst will send a written confirmation of your extension request within three weeks.

- For more details, visit the official Belastingdienst website.

2. Declaration Obligation (Aangifteplicht)

If you received a letter from Belastingdienst stating aangifte doen verplicht is (obligation to file a declaration), you must submit the declaration.

Anyone earning above a certain income level (inkomen) is required to submit a declaration.

3. Tax Payment (Belastingbetaling) and Tax Refund (Belastingteruggave)

- Amount to be paid: If the tax payable is 57 euros or more, the payment must be made by July 14, 2025 at the latest.

- Tax refund: If you have overpaid your taxes and submitted the declaration on time, you can receive your refund by the specified dates.

4. How to Submit the Declaration (Hoe doe ik aangifte?)

- Online: You can complete the declaration via Belastingdienst's website using DigiD.

- Through a tax advisor or accountant: You may seek professional assistance in submitting your declaration.

5. Required Documents for the Declaration (Benodigde Documenten)

When completing your declaration, the following documents are necessary:

- Income Statement (Loonstrook): Pay slips for employees.

- Bank Account Statements (Bankafschriften): Bank account statements to prove income and expenses.

- Tax Payments (Betaalde Belastingen): If you have made any other tax payments, those documents are needed.

- Property Documents (Eigendomspapieren): If you own property, documents related to property tax.

- Other Relevant Documents: If you are self-employed, income and expense documents related to your business.

6. Penalties (Boetes en Rente)

Failure to submit the declaration within the specified period may result in late payment interest (belastingrente) or fines (boete). If the declaration is submitted late without an extension, additional penalties may apply.

By submitting your tax declaration on time, you can avoid penalties and expedite the tax refund process. For more information, visit the official Belastingdienst website or contact a tax advisor.

Would you like to get more information about us? Click on the link or access all our articles in the About Us category.